About Us

Welcome To The Energy House Holding Company

“The Energy House Holding Company K.S.C.P. (Energy House) – formerly known as AREF Energy Holding Company – was established in September 2007. The company operates in accordance with the Capital Market Authority (CMA) Law No. 7 of 2010 and its Executive Regulations. Energy House is listed on the Boursa Kuwait and engages in investment activities across the energy sector, both locally and regionally.”

Our Vision

To become the leading energy investment holding company in the region with a strong business identity, with distinctive high performing assets, an environmentally friendly conscience, with high quality, competent personnel, in order to maximize stakeholder’s returns and capital value.

Our Mission

-

To manage investments in the energy sector including hydrocarbons, power and other related energy sources, services, equipment and technologies in the MENA region and globally.

-

Create a strong business identity by providing strategic guidance to our subsidiaries and affiliates for capacity building and growth, while meeting international standards of excellence in all aspects of business operations, processes and ethics.

-

Multiply our stakeholders’ satisfaction by generating wealth and adding value, embracing an environment-friendly culture and training employees for quality output, growth and innovative contribution.

Our Values

We adhere to a clear set of values that will drive our operating principles and business ambitions, which are fundamental to the way we work.

Board & Management

Mr. Yaqoub Yousef Bander

Chairman

Mr. Yaqoub Bandar holds an MBA from the Gulf University for Science and Technology (2011) and a BSc in Finance and Financial Institutions from Kuwait University (2003). Between 2005 and 2020, he worked at Gulf Investment House in Kuwait, where he held various management positions and responsibilities, eventually becoming Assistant Vice President.

Mr. Yaqoub Bandar currently serves as Chairman of Inovest in the Kingdom of Bahrain, a member of the Board of Directors of Arooj International Holding Company in Kuwait, and Managing Partner of Apex Management Consulting in Kuwait. Mr. Yaqoub Bandar has also served on the boards of several joint-stock companies in the Gulf countries.

From 2004 to 2005, Mr. Yaqoub Bandar served as an Investment Supervisor in the Investment Sector at Kuwait Finance House. He is also an International Certified Valuation Specialist.

Mr. Qutaiba Saad Al-Adsani

Vice Chairman

He currently heads the executive management of Watani Wasata Financial Brokerage – WFBC. He has over 20 years of experience in investment, trading, and leadership in the financial sector, brokerage operations, capital markets, and corporate governance. He also has a proven ability to drive growth, develop strategic initiatives, and lead high-performance teams in a rapidly evolving business environment.

Mr. Qutaiba Al-Adasani holds a bachelor’s degree in accounting from the Modern Academy for Computer Science and Information Technology (Cairo).

Mr. Ali Hussain Ali Baqer

Board Member

Mr. Ali Baqer holds a Bachelor’s degree in Security Sciences from the Saad Al-Abdullah Academy for Security Sciences (Kuwait) and served as a former Brigade in the Ministry of Interior.

Ms. Zainab Ahmad Saleh

Board Member

Holds a Bachelor of Laws degree from the Kuwait International College of Law.

Mr. Ahmad Mohammad Al-Kandari

Board Member

A Senior Planning Controller with over 10 years of experience in the oil sector, specializing in financial planning, budget control, and cost optimization. Currently seconded to Kuwait Oil Company (KOC) through Abraaj Energy General Trading & Contracting Co., he previously worked at the Public Institution for Social Security

He has great skills in analysing financial performance, managing operational expenditures, and aligning budgets with organizational goals.

He holds a Master’s in Information Studies from Kuwait University and a Bachelor’s in Business Administration (Finance) from the University of Wisconsin-Milwaukee.

Eng. Hamad A. AlQahtani

Chief Executive Officer

Mr. AlQahtani has over 21 years of professional experience in the oil and gas sector, investments, restructuring, planning, and business development.

He held a various position for over the years at Kuwait Projects Company (KPICO Group Holding) subsidiaries started as Project Development Manager at United Oil Projects, VP Business Development and Marketing at Soor Fuel Marketing Company and Deputy CEO for planning and Development at Kuwait Hotels Company.

After that, he held a position of CEO at Invita Kuwait for Information Technology (subsidiary of NTEC owned by KIA).

Mr. Al-Qahtani is currently Board member in several companies.

Mr. AlQahtani holds a Bachelor’s Degree in Mechanical Engineering from Catholic University of America, Washington D.C. and an MBA from Kuwait Maastricht Business School.

Miss . Susan Hammad

Finance Manager

Susan Hammad, CPA, CIDA

Susan Hammad is a finance professional with extensive expertise in audit, investment analysis, corporate finance, strategic planning, budgeting. a Certified Public Accountant (CPA) and holds the Certified Investments and Derivatives Auditor (CIDA) designation, reflecting her depth of knowledge in both financial reporting and complex investment instruments.

Her career foundation was built at Deloitte, where she gained rigorous experience in audit, assurance, and advisory services. She later advanced into investment analysis and corporate finance, applying her skills to guide strategic decision-making and evaluate opportunities across diverse industries.

With almost a decade of leadership in the aviation sector, Susan has specialized in financial planning, cost management, combining analytical expertise with operational insight. Her background enables her to bridge the gap between finance, operations, and strategy, consistently delivering value in complex and dynamic environments.

Investments

Higleig Petroleum Services and Investment Company ("HPSIC")

Established: 1997

Energy House Shareholding: 64%

HPSIC is a Sudanese company working in EPC, civil/infrastructure and the oil & gas industries in Sudan, South Sudan and Iraq. They are also qualified and capable of oil drilling and oil & gas plant construction.

HPSIC has the advantage of a large scale operation and asset base, combined with long operational experience in North Africa, which earned them a leading position as a preferred contractor for government projects.

Synfuels International (“Synfuels”)

Established: 1998

Energy House Shareholding: 25%

Including exclusive marketing rights for the Arabian Gulf, MENA, FSU and Indian Sub-continent regions

U.S. based Synfuels is the developer of a revolutionary patented Gas-To-Liquid (GTL) technology, based on the ECLAIRS process. The ECLAIRS process has significant advantages over the Fischer-Tropsch process and conventional technology in terms of capital and process costs, product throughput, yields and quality.

Their competitive advantage is the economic benefits of this technology combined with ease of implementation makes it the perfect choice for oil and gas producers with stranded gas flaring to capture lost revenue while reducing carbon emissions. Additionally, their technology is ideal in utilizing low value gas (including ethane) and converting to higher value liquids.

Nordic Energy FZE (“Nordic”)

Established: 2006

Energy House Shareholding: 92.5%

Nordic is a snubbing & work-over, coiled tubing and well intervention company, based and operating in the United Arab Emirates.

Since inception, Nordic has strategically grown from a small well services company to a company with a fleet of sophisticated thru-tubing tools, coiled tubing units and advanced snubbing & work over units.

To better supply the customers with oilfield servicing solutions, the company also offer specialized fishing tools, thru-tubing cutting systems, and scale removal systems to its services. With its unique expertise, Nordic also provides support to drilling operations by supplying equipment and personnel on many well service operations within the oil and gas industry, that sets Nordic apart from any other company in the Middle East region.

The company is currently active in Turkmenistan, Oman and Saudi Arabia.

Al-Taqa Fund

In 2012, Energy House invested in the Al-Taqa Fund L.P. (a Sharia compliant parallel fund) through AREF Energy International Limited (a 100% subsidiary of Energy House and an exempted company incorporated in the Cayman Islands with limited liability). Kerogen capital is an independent private equity fund adviser established in 2007. It manages the Kerogen Energy Fund L.P. (and the parallel Sharia compliant Al-Taqa Fund L.P.), collectively a USD 1 Billion Fund, which specializes in providing growth and development capital to small and medium- size companies in the oil and gas sector. Kerogen Capital is based in Hong Kong with a presence in London. Kerogen Capital focuses on investments in international emerging basins, particularly those with a nexus to Asian demand and investment flows. It also invests selectively in unconventional oil and gas projects. The Kerogen team is comprised of oil and gas industry experts with technical, operational and private equity management experiences, in addition to an extensive strategic network.

www.kerogencap.com

Saudi Makamin Company for Oil and Gas Services (“Makamin”)

Established: 2008

Energy House Shareholding: 10%

Saudi Makamin provides diverse services to the oil and gas sector in the Kingdom of Saudi Arabia and abroad including work-over and deep-water drilling, non-destructive testing services, fabrication of pipelines, site preparation, geophysical and geological studies. In addition to that, the company offers other services involving advanced-technologies throughout its investments and alliances with international partners including i-fields and SCADA services, manufacturing and supply of wireline tools (PNLs) and passive seismic.

Over the past few years, the company demonstrated great ability to undertake operational contracts with high success rates in its bidding activities with major oil and gas companies in the region, including Saudi Aramco. Makamin also took great steps in creating successful international alliances.

Makamin is progressing rapidly to increase its market share in the Kingdom of Saudi Arabia and implement more operational projects in the region through its distinctive business development and marketing teams who are closely monitoring the market to capture lucrative business opportunities in order to maintain and grow the company’s profits and overall financial performance.

Oil Field Instrumentation (India) Limited (“OFIL”)

Established: 1992

Energy House Shareholding: Indirect ownership of 12.9% (36.36% of the Special Purpose Vehicle/Fund "Kitara-OFIL" holding 35.49% of OFIL)

OFIL provides mud logging services to corporate establishments that are engaged in oil well drilling, exploration and development, including deep water and coal bed methane (CBM).

The Company manufactures its own proprietary mud logging units (MLUs) and also provides rig instrumentation and services for accurate, reliable and globally accessible online - real time drilling data using pressure indicators, diaphragms, driller consoles, recorders, etc. The Company also provides real time gas evaluation systems consisting of FID/TCD gas chromatograph (GC) with sensitivity in PPM. The Company currently operates in India and other parts of the MENA region.

OFIL is the market leader in Mud Logging in India with a 45% market share. The Company has an installed capacity of 40 MLUs and has monitored more than 2,500 wells in offshore and onshore locations.

The company has an in-house software development team for development and upgrading its mud logging software. Further, it has a pool of more than 300 well qualified and trained professionals, including data engineers, mud loggers, service engineers, computer experts, software professionals and engineers.

Investor Relations

Corporate Governannce

Corporate Governance

Energy House Holding Company is committed to generating standards of governance to ensure the achievement of company strategic objectives and keep the shareholders and stakeholders rights in line with the fifteenth book of the executive regulations of the Capital Markets Authority in the State of Kuwait.

The key objectives of corporate governance and oversight is achieving transparency and credibility, the ability handle crises and enhance administrative efficiency and to enhance management efficiency, thereby achieving protection for the shareholders.

In addition, these regulations emphasize the importance of adhering to the provisions of the law, ensure the financial performance review and the existence of administrative structures, reinforce control and audit procedures, raise the level of responsibilities, promote fairness and transparency and eliminate conflicts of interest.

Board of Directors and Committees:

The role of the Board is reflected in the representation of the company’s shareholders and take responsibility of the company’s management through the application of an effective governance system, and have a board of directors supervisory role through his leadership and control company business, as for the company daily operations, it is handled and managed by the executive management.

The general framework of the principles of corporate governance in the company is based on the independence of the Board of Directors and the segregation of the role of the supervisory board and the executive management. Therefore, the company has formed a number of committees that work on the follow-up the activation of corporate governance regulations and enhance the level of transparency and integrity in their operations, including:

The Audit Committee

The Audit Committee is primarily responsible for assisting the Board in performing its responsibilities regarding the integrity of the financial statements, the performance of the external auditors, and monitoring the internal audit function, business practices and ethical standards of the Company in a manner consistent with the applicable regulatory requirements.

The Risk Committee

The Risk Committee is working to assist the Board in the performance of its responsibilities in the supervision of the existing and future risk situations as well as its role in determining the risk tendency of the company and to identify methods and mechanisms to mitigate risks along with the regulatory requirements applicable in this regard.

The Nomination and Remuneration Committee

The primary role of the Nomination and Remuneration Committee is the selection and giving recommendation to the Board of Directors about nomination for new membership of the Board and its committees and executive management with candidates are able to strengthen the Board and executive management ability to manage and guide the company’s businesses effectively. Besides its role in the development of a clear policy for granting of bonuses and compensation that would establish the principle of belonging to the company and motivate employees to work to achieve the company’s goals.

Transparency and Disclosure of information

The company is committed to disclose the exact integrated information to shareholders within the framework of transparency. The company guarantees the application of integrated practices and procedures for disclosure of information, since transparency creates the atmosphere of trust and confidence internally and externally.

Code of Ethics

The company seeks to apply the highest standards in the values of professional ethics conduct which are based on a number of bases and major props, also the company expects from their employees and all its representative to act in accordance with the highest personal integrity and professional standards in all activities and comply with the laws and regulations as well as the company’s policies.

Those bases has been developed through a system of policies and procedures, which include:

Code of Ethics

Organize the transactions with related parties

Organization of conflict of interest

Protecting the stakeholders rights

Shareholders Right

Click Here

The complaints and whistleblowing Unit

In case of any complaint, kindly hand over all related supporting documents followed either of the following ways:

By hand to the company’s headquarters located at the Al-Enmaa Tower, 14th Floor, Abdullah Al-Mubarak Street, Kuwait City.

By regular mail to the following address: PO Box 21909 Safat 13080 Kuwait.

By e-mail: whistleblowing@energyhouse.com.kw

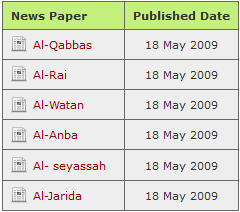

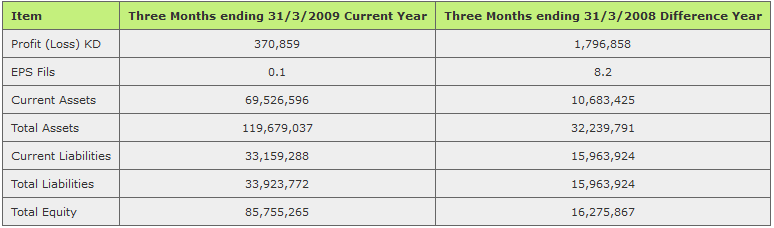

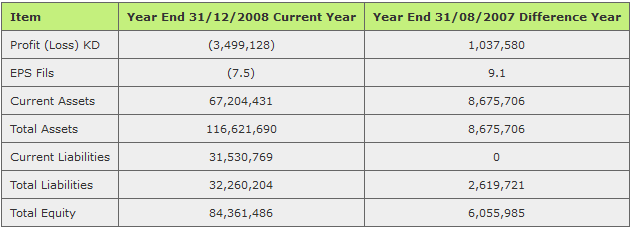

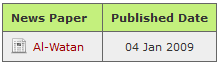

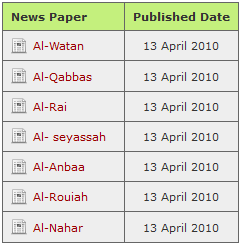

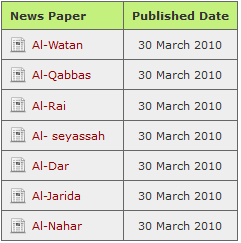

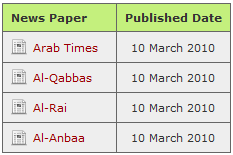

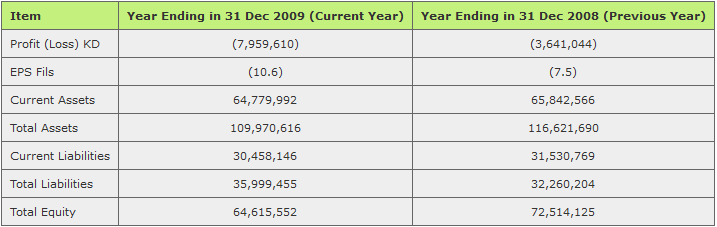

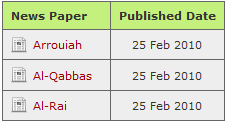

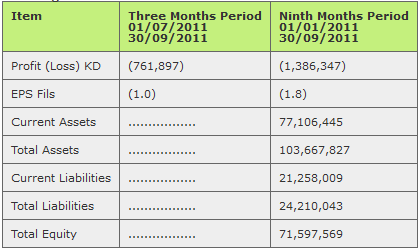

Disclosure & News

useful links

WTI Crude Oil Price:

WTI Crude Oil

WTI Crude Oil

Brent Crude Oil Price:

Brent Crude Oil

Brent Crude Oil

Company Address

Al-Enmaa Tower, Floor 14,

Abdullah Al-Mubarak Street,

Al- Mirqab, Kuwait City

P.O. Box : 21909 Safat, 13080 Kuwait

Tel : +965 2297 9600

Fax : + 965 2247 7580

Website : https://energyhouse.com.kw

Email : info@energyhouse.com.kw